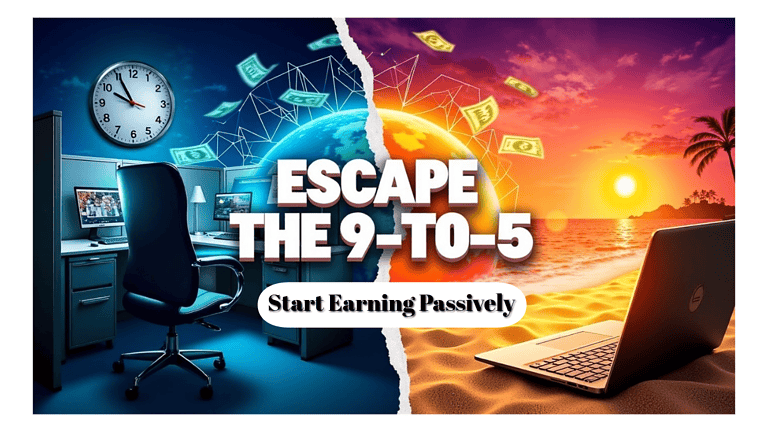

In today’s fast-paced, stress-laden lifestyle, breaking free from the 9-to-5 grind is no longer a dream—it’s a necessity. With inflation rising and job security becoming an illusion, passive income is the holy grail of financial freedom. It enables you to earn money while you sleep, giving you control over your time, energy, and life choices. Here are 7 proven passive income ideas in the Indian context, all quoted in INR, that have the power to not only supplement your income—but completely replace your traditional job.

1. Invest in Dividend-Paying Stocks (Earning ₹30,000–₹1,00,000+/month)

Dividend investing is a classic passive income strategy where you buy shares of established companies that pay regular dividends. In India, blue-chip companies like Tata Consultancy Services (TCS), HDFC Bank, and ITC consistently offer attractive dividend yields.

- Initial Investment: ₹5–10 lakhs for meaningful returns

- Platform: Groww, Zerodha, ICICI Direct

- Income Frequency: Quarterly or Annually

- Taxation: Taxed as per slab under “Income from Other Sources”

📈 Pro Tip: Reinvest the dividends to benefit from compounding and long-term wealth creation.

2. Rental Income from Real Estate (Earn ₹15,000–₹2,00,000+/month)

Buying a residential or commercial property and renting it out is a time-tested passive income model. Cities like Pune, Bangalore, and Hyderabad offer high rental yields for IT professionals and students.

- Initial Investment: ₹25–80 lakhs

- Income: ₹15,000–₹2,00,000 per month depending on location and property size

- Platforms: MagicBricks, NoBroker, 99acres

- Taxation: Standard deduction of 30% available; balance taxed as per slab

🏠 Bonus: Opt for co-living spaces or student hostels to improve occupancy and returns.

3. Start a YouTube Automation Channel (Earn ₹10,000–₹5,00,000+/month)

YouTube automation is the art of creating faceless channels where scripts, voiceovers, and editing are outsourced. Monetization kicks in once you reach 1,000 subscribers and 4,000 watch hours.

- Initial Investment: ₹20,000–₹1,00,000 (for outsourcing)

- Revenue Sources: AdSense, brand deals, affiliate marketing

- Tools: Canva, Pictory, InVideo, Fiverr

- Time to ROI: 3–6 months with consistent uploads

🎥 Niche Ideas: Finance, Tech Explainers, Motivational Stories, Indian History

4. Sell Digital Products on Etsy & Gumroad (Earn ₹5,000–₹2,00,000/month)

Digital products like printable planners, resume templates, budget sheets, and eBooks sell like hotcakes globally. Platforms like Gumroad and Etsy make it easy to reach an international audience.

- Initial Investment: ₹5,000–₹20,000 (design tools & templates)

- Skills Needed: Basic Canva skills, content writing

- Revenue: Recurring every time someone downloads your product

- Popular Products: Wedding templates, journaling kits, Indian mandala coloring pages

🛍️ Bonus: Sell once, earn forever—no shipping, no inventory!

5. Peer-to-Peer Lending (Earn ₹10,000–₹50,000/month)

P2P lending platforms allow you to lend directly to borrowers and earn 9%–12% returns annually. This is regulated by RBI and suits investors seeking monthly income.

- Platforms: Faircent, LenDenClub, LiquiLoans

- Minimum Investment: ₹5,000

- Expected Return: 9%–12% per annum

- Risks: Loan defaults (Mitigated by diversifying across borrowers)

💡 Tip: Start with ₹50,000 split across 50 borrowers (₹1,000 each) for minimal risk.

6. Create an Online Course (Earn ₹20,000–₹3,00,000/month)

Have a skill—digital marketing, coding, cooking, finance? Package your knowledge into an online course and sell it on platforms like Udemy, Teachable, or Graphy.

- Initial Investment: ₹10,000–₹30,000 for production

- Earning Potential: Unlimited (depending on audience size)

- Recurring Income: Yes—once the course is created, you earn passively

- Marketing: Use Instagram, Quora, and email marketing to promote

📚 Top-Selling Niches in India: Stock Market Basics, Career Building, Freelancing Skills

7. Invest in REITs (Real Estate Investment Trusts) (Earn ₹5,000–₹50,000/month)

If direct property investment feels too capital-intensive, REITs offer the perfect alternative. Listed REITs like Embassy Office Parks, Mindspace, and Brookfield let you invest in commercial real estate with as little as ₹10,000.

- Initial Investment: ₹10,000–₹1,00,000

- Returns: 6%–8% via dividends + capital appreciation

- Liquidity: High, since they’re listed on NSE/BSE

- Taxation: Interest income taxed as per slab; capital gains taxed at 10% (LTCG)

🏢 Why REITs? Low risk, regulated, and suited for conservative investors seeking passive income.

How to Build a Portfolio of Multiple Passive Incomes

Relying on a single source of passive income is a mistake. Instead, diversify your income streams just as you would diversify your investment portfolio.

| Income Source | Risk | Monthly ROI (%) | Recommended Allocation |

|---|---|---|---|

| Dividend Stocks | Low | 1%–2% | 25% |

| Real Estate Rental | Moderate | 2%–3% | 30% |

| Digital Products | Low | 5%–15% | 10% |

| YouTube Channel | Medium | 3%–10% | 10% |

| Online Course | Low | 5%–12% | 10% |

| P2P Lending | Medium | 1% | 10% |

| REITs | Low | 0.5%–1.5% | 5% |

✅ Rule of Thumb: Reinvest 50% of your passive income for faster financial independence.

Final Words: Replace Your Job with Smart Income Streams

With cost of living rising and corporate jobs offering diminishing returns in terms of time and money, now is the time to act smart, not work hard. Each of these passive income ideas in INR are not get-rich-quick schemes—but solid, proven models that can replace your 9-to-5 job if executed with discipline, research, and consistency.

Start with one income stream, master it, and then branch out. Within a few years, your passive income can outpace your salary, giving you the freedom to live life on your terms.