“Insurance is a means of protection from financial loss. Investing is a means of creating wealth.”

Information Sources For Buying Insurance Products

| 34% | Friends, Family & Colleagues |

| 3% | Direct contact with bank or insurance company |

| 20.22% | Newspapers & Magazines |

| 8.07% | Television |

| 7.30% | Internet |

| 19% | Intermediary agents |

What are ULIPs and Endowment plans?

●They are both insurance cum investment products. Neither of them is recommended as they offer a sub-optimal combination of insurance and investment.

●ULIP is a market-linked insurance scheme where the scheme invests in equity or debt oriented schemes, whereas endowment plans offer a guaranteed benefit called the sum assured.

Why are they so Popular?

- A lot of people buy insurance in haste and that too for the sole purpose of saving tax and they do so without fully understanding the products.

- Often the insurance agent is a neighbour, or a friend or, even worse, a relative. It’s kind of difficult to turn them down. So, we end up buying an endowment or an ULIP without giving it much thought. Also, these policies are pushed hard by agents as they involve attractive commissions.

- Many people see insurance as an useless expense and hence they think it’s better to just buy a product that will give some return as well. Just like they fail to see the effect of inflation, they fail to see the sub-optimal returns from these products.

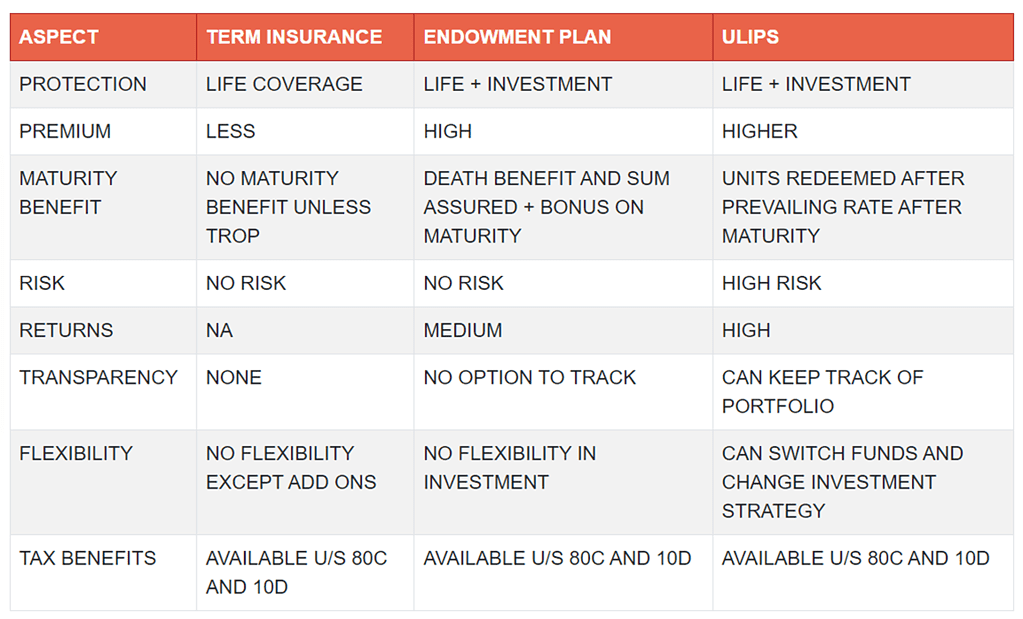

What’s wrong with Endowment Plans & ULIPs?

- High charges: Endowment plans and ULIPs can have high charges for administration, management, and other fees, which can eat into your returns.

- Complexity: These products can be complex, with many different options and features to choose from. It can be difficult to understand all the details and make an informed investment decision.

- Lack of transparency: The charges and returns associated with endowment plans and ULIPs may not be clear, which can make it difficult to evaluate the true cost of these products.

- Limited investment options: Endowment plans and ULIPs may limit your investment options, as your money is typically tied up in a single product for a specified period of time.

- Lower returns: Endowment plans and ULIPs may not provide the same level of returns as other investment options, such as mutual funds or stock market investments.

ENDOWMENT PLANS VS TERM PLANS VS ULIPs

Comparative Returns (₹)

| Alternatives | Endowment Plan | ULIP | Term Plan + Equity MF |

| Plan | LIC Jeevan Anand | ICICI Pru Life – Group Growth Fund | HDFC Click2Protect + ICICI Value Discovery Fund |

| Life Cover | ₹4 Lakh | ₹5 Lakh | ₹50 Lakhs |

| Annual Premium | ₹50000 | ₹50000 | ₹50000 (₹7000 for term plan & ₹43000 in MF) |

| Maturity Value (After 10 Years) | ₹7.25 Lakh | ₹9.16 Lakh | ₹10.61 Lakh |

| Rate of Return | 6.66% | 10.78% | 15.96% |

Advice

Insurance is an expense and it should be treated like an expense. Don’t mix insurance with investment. Mixing the two will give you less than moderate returns from both.

What can you do now?

(1) There is something called the free-look period that is valid for 15 days. If you are not satisfied with the insurance you bought, you can return it within 15 days of buying and get a refund.

(2) If your policy is older than 15 days, we would suggest you to return it, bear the corresponding loss and buy a term plan immediately. Rest of the money, you should invest in well-diversified equity mutual funds.

For More Details contact us at contact@finviseindia.com or visit our websites:

www.finviseindia.com

www.fvindia.com